Table of contents

No headings in the article.

In the last few years, Investing in stocks has been more accessible, with newcomers/ newbies able to start an account with little money using a brokerage's website or mobile application. Constantly learning from the recent Covid outbreak, investment is definitely the way to go — not only to boost your savings but also to give your reserve a fighting chance against inflation. And what better way to get started than with a bang?

Don't know where to begin? We're here to put your mind at ease. The best investment methods are frequently the most straightforward. Let's take a look at a few common beginner investment ideas.

Introduction

Before you start investing, it’s crucial to nail down a few things.

So, let's discuss some basics now because many of us don't even know what is stocks, why people invest their money there, and what is the overall process?

Investing in stocks entails purchasing stock in a publicly-traded company. The company's stock is made up of those small shares, and by trading in it, you're betting that the firm will develop and perform well over time. Your investments may become more expensive as a result of this, and other investors may be ready to buy them from you at a higher price than you spent for them. That indicates if you chose to sell them, you could make a profit.

Over the past few years, the stock exchange has generated great riches. The S&P 500, which contains 500 of the largest publicly traded corporations in the United States, has averaged an annual return of 8% to 12%. If you had put $10,000 in the stock market 50 years ago, it would have increased to about $380,000 today.

Stock market investing is a long-term endeavour. Putting money into a web-based investment account, which could then be used to invest in shares of stock or stock mutual funds, is one of the greatest ways for newcomers to get began buying stocks.

With many investment accounts, you can actually invest for the price of a single share. Some companies also provide paper trading, which allows you to practice buying and selling stocks using stock market simulators before investing real money. A solid guideline is to diversify your investment strategy and continue investing, even when the market is experiencing ups and downs, as it is now in early 2022.

Market selloffs have been triggered by recent concerns about increasing prices, Russia's invasion of Ukraine, Federal Reserve interest rate hikes, and the COVID-19 pandemic. However, most financial gurus will advise you to buy and hold all of them.

Sometimes people put off investing as they believe it takes a lot of money to get started in the stock market. But this is simply not the case. You can begin investing as little as Rs. 500 each month. The key to accumulating wealth is to form excellent habits, such as investing a small sum of money in the stock market every month. You will be in a lot better financial position for the future if you make it a practice to invest on a regular basis.

How to invest in the stock market: 8 tips for beginners

- Buy the right investment

- Avoid individual stocks if you’re a beginner

- Create a diversified portfolio

- Be prepared for a downturn

- Try a simulator before investing real money

- Stay committed to your long-term portfolio

- Start as soon as possible

- Avoid short-term trading

How should I plan my investments?

The following steps will assist you in making your first investment and will provide with you all of the fundamentals necessary to not only become a more informed investor but also to shield you against scams and frauds.

The first stage in investment planning is to choose the best investment for your background and needs. When making investment decisions, bear the following in mind:

- After conducting a thorough study, carefully select investments.

- Don't be fooled by quick-money scams that promise big profits in a short period of time.

- Evaluate your stock and mutual fund holdings on a regular basis.

- Assess the tax consequences of the investment returns you generate.

- Keep things simple and steer clear of sophisticated investments that you are unfamiliar with.

Here are three important tips for beginners:

- While Movies portray investors as aggressive traders, a passive buy-and-hold strategy can help you succeed – even outperform most investors. One technique is to buy and hold an S&P 500 index fund, which contains America's largest corporations, on a regular basis.

- Tracking your portfolio can be beneficial, but be cautious when the market falls. You'll be tempted to sell your stocks and deviate from your long-term strategy, jeopardising your long-term earnings in the process. Consider the long term.

- To avoid spooking yourself, it's a good idea to just glance at your portfolio at certain times of the month (say, the first of the month) or at tax time.

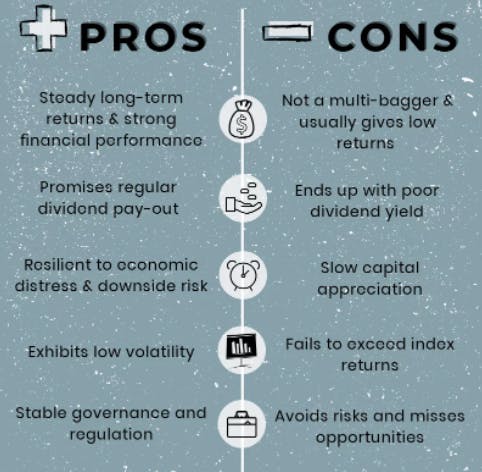

Benefits of investing in stocks

- The potential to earn higher returns

- Takes advantage of a growing economy

- The ability to protect your wealth from inflation

- Liquidity

- The pride of ownership

- Diversification

Drawbacks of Investing in Stocks

- Stock prices are risky and volatile

- Common stockholders paid last

- Emotional roller coaster

- Professional competition

To summarise!!

After you've opted to invest in stocks, you'll need to open a brokerage account, fund it, and purchase shares. Following that, it's critical to have a long-term mindset. If your stocks, for example, fall in value, it can be quite tempting to panic and sell. Remember how carefully you selected them, and don't sell your stocks until you've thoroughly investigated the company's status.

CONCLUSION

Instead of leaving your savings in the bank, invest them so that you can generate income even while you sleep. Investment may be quite profitable, especially if you eliminate some of the common traps that beginning investors face. Beginners should devise an investment strategy that suits them and stick to it through good and bad times.